This Honest Truth has been produced and shared as the UK Politicians and the Media do not lay out the true state and problems facing the UK, the Politicians just blame each other for the problems and do not confront the enormous obstacles we face as a nation.

FixUK will set out “The Honest Truth” of the state of the UK and explain why if we don't address the situation, living standards, quality of life and opportunities in the UK will decline further and faster.

There are many external and unforeseen factors in the last 15 years that have not helped but there are also self-inflicted choices and a series of unintended consequences which were not considered and have not been addressed.

So what is The Truth?, it is that the current National Debt is £2.8 Trillion (£2,800,000,000,000), This equates to £103,942 of debt for every tax-paying working person in the UK—money that various governments have spent on your behalf. This debt is set to go up further, as it is not being addressed. This has a cascading effect, preventing expenditure on the social justice and improvements that are ideally needed. Ultimately, it means you pay so much in tax that it worsens the cost of living crisis.

That UK National debt in 25/26 is likely to increase by £-137.3 Billion (£87,000,000,000). The Governments have barely been tinkering around the edges to reduce the debt and in reality, adding more to the burden of future generations by lack of action.

The current cost of running the UK Government is £1.3 Trillion (£1,335,000,000,000) which equates to £47,849 per tax paying working person in the UK, that is simply too high to sustain. It also means that currently UK population is under its highest ever burden of tax forecast to be 38.3% of GDP, even more than after the Second World War (1945).

See the Government Tax and Spend Numbers for summary of numbers to investigate them for full transparency, so you can fact check them and use them to form your own opinions on what needs to change.

It is not uncommon for countries to be in debt but there are also off the book Government liabilities not accounted for which make the position worse, namely unfunded Public Sector Pensions, which amount to £1.7 Trillion and unfunded Healthcare liabilities of over £300 Billion.

Additionally, there are various unfunded government commitments, such as the compensation for the infected blood scandal. Including these liabilities would increase the National Debt to over £4.8 Trillion. This equates to a total of £172,043 for every working taxpayer. To put that in perspective, this figure far exceeds the £20 Billion "fiscal black hole" that was widely reported in the news last year.

To confuse the position there was an accounting adjustment in June 2024 of a sharp drop in UK public sector net debt from £3.092 trillion in May 2024 to £2.732 trillion in June 2024 the reduction of about £360 Billion—was primarily due to a large one-off reclassification and accounting adjustment, not a sudden fiscal surplus or repayment.

The UK GDP is growing but often that can be down to population changes, so the GDP per person is a better measure of the economy. So lets look at a 10 year comparison.

| Metric | 2015 (Actual) | 2025 (Estimate) | 2015 Adjusted to 2025 | Difference |

|---|---|---|---|---|

| GDP (£ Trillions) | £1.90 | £2.84 | £3.24 | -£0.40 |

| GDP per capita (£) | £29,236 | £41,492 | £49,703 | -£8,211 |

So, if the 2015 GDP had kept pace with inflation, it would be £400 Billion higher than the current 2025 figure, and GDP per capita would be £8,211 higher.

Why this is not sustainable, is that without significant growth or inflation the ability to sustain what we have now will become unaffordable and the continual attempts to make Growth will actually have more of an adverse path, reducing Government Revenue and increasing costs, so continuing the debt and interest pay out spiral. Anybody who has been in debt or has to juggle to pay the bills, understands this vicious cycle and how depressing and helpless it can be without a plan and actions to change things for the better, otherwise it is more decline and increased depression.

What all this comes down to is on the current course, every person in UK faces higher taxes and decreased benefits and services, with lower living standards going forward forever, the country could not easily absorb another external shock or extra interest bill if investors decided not to fund the UK National Debt. A one percent rise in interest rates would add £29 Billion to payments, which is about the amount paid annually for Policing and Justice.

The current economic backdrop is highly precarious. A single external shock—beyond the Government’s control—could trigger a financial collapse. We are operating in a danger zone of fiscal recklessness, and the consequences could surpass those of the 2008 crisis or the 1970's with an IMF bailout.'

Unlike previous downturns, this time we face the compounded risks of persistently high inflation, declining living standards, and widespread job losses. Without urgent corrective action and responsible governance, the damage could be deeper and more enduring.

To get the National debt of £2.8 Trillion to 50% of that level at £2 Billion per week with cumulated interest at 3.5% it would take 72.44 years to pay down the debt, to that more sustainable level. We are currently adding to the National Debt by spending more than revenue, this year £87 Billion is expected to be added to the National Debt, unless changes are made.

If we could pay down the National Debt by £3 Billion per week, then the debt would become manageable in under 20 years but at the moment it is simply not practical to reduce the debt by £150 Billion per year.

If this were a business or an individual it would have to declare bankruptcy.

Recommending a target of £100 Billion per year is paid of the National Debt, that will start reversing the decline. It will not be painless but it will get better.

For those that want a history of how we got here and how we compare to other similar countries, please see History National Debt.

It is worthy to note UK Governments since 2000 have introduced 24 new taxes, with pace increasing in recent years. With most rates increasing and allowances being eroded by inflation. These sticking plaster approaches, to try and balance the books, whilst not breaking election promises are damaging. The extra taxes are getting targeted on specific groups, not the main group of those that pay tax, the working people. Those groups will continue to change behaviour and not as much tax will be collected as predicated, making the situation, even harder to solve.

You can look through and debate how we got here but The Honest Truth is this is not sustainable and there is no sufficient national plan only rhetoric, good wishes and desire to improve the position. We aim to help correct that.

The UK is currently facing significant economic challenges, and as living standards continue to decline, there is a growing risk that public frustration may be misdirected toward immigrants—both legal and illegal. While immigration has played a role in shaping the current landscape, it is overly simplistic and historically dangerous to scapegoat communities that are often among the most vulnerable. Channelling discontent in this way not only fails to address the root causes of economic hardship but also risks deepening social divisions and perpetuating cycles of misery. A more constructive path lies in addressing systemic issues through inclusive and evidence-based policy.

The UK must recognise that the bulk of taxation falls on the 33 million working people, while a small minority top-rate taxpayers—contribute a disproportionately large share of revenue. Targeting this group with increasingly high taxes is risky. If they begin to feel unfairly singled out, they have the financial flexibility to relocate, taking their tax contributions with them.

Marginal tax increases on this group may seem politically appealing, but they represent only a small fraction of the total tax take. The real danger lies in undermining confidence and incentivising capital flight, which could weaken the overall tax base and harm public services. A balanced, fair, and sustainable approach to taxation is essential to maintain economic stability, aspiration and social cohesion.

So the first part is to agree what is “The Honest Truth” and then accept big changes are needed and why it is important to make changes.

To aid this and start the conversation and maybe even a FixUK movement, a series of suggested changes which move the dial to reduce the National Debt by over £100 Billion (£100,000,000,000) per annum, which in turn reduces the interest the Government has to pay out and moves the country in the right direction, which will eventually benefit the entire UK population and remove the burden on future generations.

To give you the scale of a single fix to generate the £237 Billion to take it from adding £137 Billion to reducing debt by £100 Billion, in simple terms

Instead of those simplistic single solutions, AI has prepared a series of solutions, on taxes and cost changes with rationale and calculations, to start a discussion/debate with you on what needs to be done, to put the UK on the right course.

It feels like the government is ignoring the mounting debt and financial risks, carrying on as if nothing is wrong — like Nero fiddling while Rome burns. The warning signs are clear, but instead of addressing the crisis, there's a dangerous complacency that could have serious consequences for the economy and future generations.

FixUK hopes you will take a look and get involved in changing the course for the UK. Also, it is important to make your views heard by encouraging your MP, and the political parties you support, to make the necessary changes.

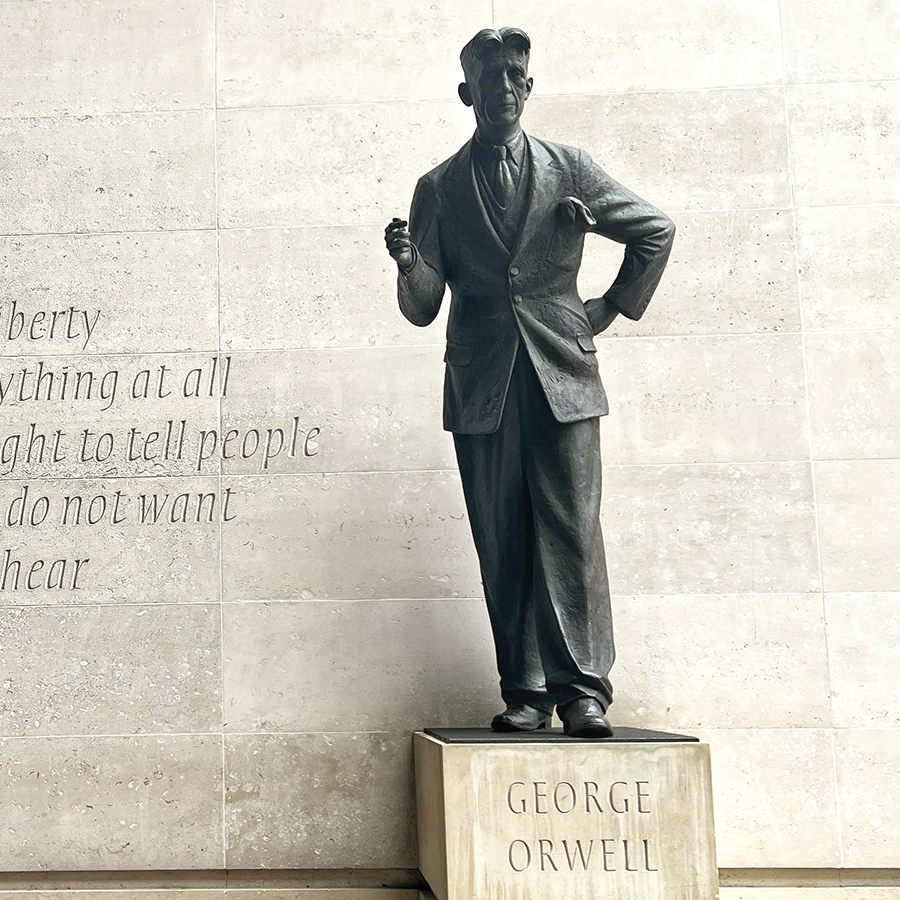

If liberty means anything at all it means the right to tell people what they do not want to hear

Click on above Flag to watch the Video The Honest Truth.

Or to the Audio Podcast.

Showing you official Numbers that relate to the UK Government Finances.

For Further Reading on many aspects and views on fixing the UK and Deep Dive articles.

For those that want to look at some of the interpretations of political rhetoric see Myths Debunked

Blessed are the young, for they shall inherit the national debt.